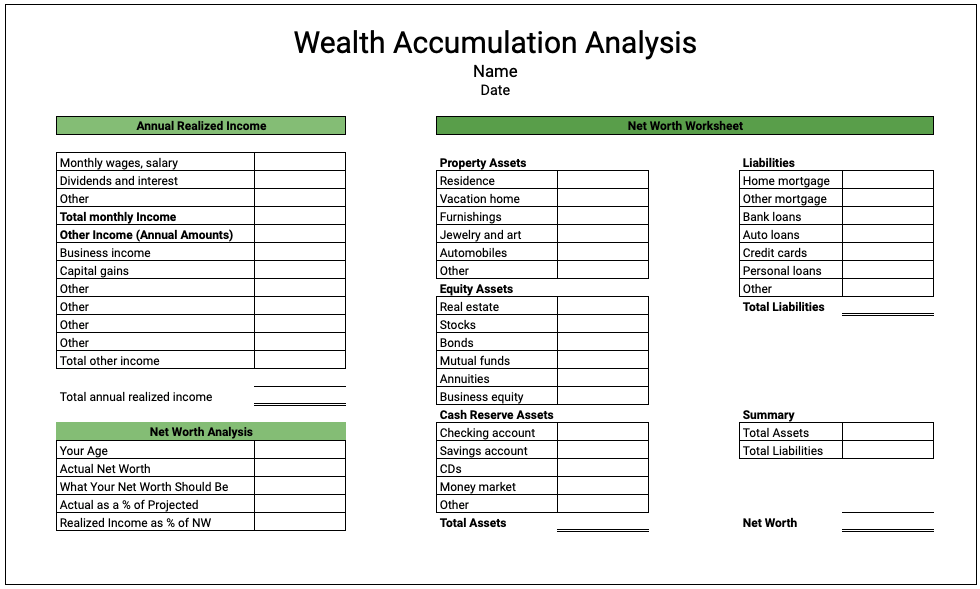

You can use this free wealth accumulation template for google sheets to calculate the wealth accumulation.

| Name: | Wealth Accumulation Template |

| Category: | Personal Finance |

| Application: | Google sheets |

| Tags: | Wealth Accumulation Template google sheets |

Screenshots of the template:

FAQ:

What is wealth accumulation?

Wealth accumulation is the process of amassing money and other assets over time. This can be done through a variety of means, including earning a high income, investing in property or stocks, or winning the lottery. The key to successful wealth accumulation is to start early and to make wise choices with your money.

How to create a wealth accumulation template?

There is no one-size-fits-all template for wealth accumulation, as the best approach will vary depending on your individual circumstances. However, there are a few key steps that can help you get started:

1. Determine your goals. What do you want to achieve with your wealth? Do you want to retire early? Buy a house? Send your children to college?

2. Make a plan. Once you know your goals, you need to develop a plan for how you will achieve them. This should include saving as much money as possible and investing it in the right places.

3. Stay disciplined. It can be easy to stray from your plan, but it’s important to stay disciplined if you want to succeed. This means sticking to your budget, investing regularly, and avoiding impulse purchases.

4. Review your progress. Periodically check in on your progress to make sure you’re on track. This will help you make any necessary adjustments to your plan.

What are some tips for wealth accumulation?

There are a number of things you can do to increase your chances of success:

1. Start early. The sooner you start saving and investing, the more time your money will have to grow.

2. Invest wisely. Don’t put all your eggs in one basket. Spread your investment across a variety of assets, such as stocks, bonds, and property.

3. Live below your means. Avoid lifestyle inflation by living below your means. This will free up more money to save and invest.

4. Stay disciplined. It’s important to stick to your plan and resist the temptation to splurge.

5. Review your progress. Periodically check in on your progress to make sure you’re on track. This will help you make any necessary adjustments to your plan.