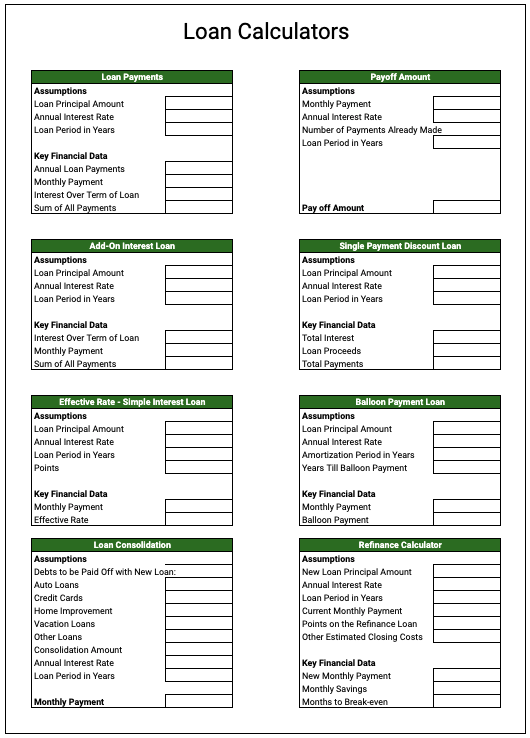

This template contains 8 calculators that you can use to do loan related calculations.

These calculators are:-

- Loan Payments – This calculator helps you to calculate monthly loan payment required to pay off your loan

- Payoff amount – This calculator tells you how much principal loan amount is remaining after all the payments you have made till date

- Add-on interest – This calculates the monthly payment required for an add-on loan interest

- Single payment discount loan – This calculates the one payment that you need to make at some point of time in the future. The payment includes principal and interest amount

- Effective rate – Calculates the annual cost of a loan based on its rate, point and term

- Balloon payment – Calculates both monthly and final payment for balloon type of loan

- Loan consolidation – It calculates the amount you need to pay if you want to consolidate all of your loans and debts into one single loan payment

- Refinance calculator – It tells you the monthly payment and the months required to break-even on a refinance loan

| Name: | Loan Calculators Template |

| Category: | Personal Finance |

| Application: | Google sheets |

| Tags: | Loan Calculators Template google sheets |

Screenshots of the template:

FAQ:

What is the loan principal amount?

The loan principal amount is the amount of money that you borrow from a lender. The principal is the amount of money that you are responsible for repaying, not including interest or fees.

What is the loan interest rate?

The loan interest rate is the percentage of the loan amount that you will be charged for borrowing the money. The higher the interest rate, the more you will have to pay in interest over the life of the loan.

What is the loan term?

The loan term is the length of time that you have to repay the loan. The term can be anywhere from a few months to several years.

What is an add-on interest loan?

An add-on interest loan is a loan where the interest is calculated on the principal amount plus any interest that has accrued since the last payment was made. This type of loan can cause the borrower to end up paying more in interest than they would with a simple interest loan.

What is simple interest?

Simple interest is a type of loan where the interest is calculated only on the principal amount of the loan. With this type of loan, the borrower will not end up paying more in interest than they would with an add-on interest loan.

What is loan consolidation?

Loan consolidation is when you combine multiple loans into one single loan. This can help you save money on interest and make your monthly payments more manageable.

What is loan refinancing?

Loan refinancing is when you take out a new loan to pay off an existing loan. This can help you save money on interest and lower your monthly payments.

What is the payoff amount?

The payoff amount is the total amount of money that you will need to repay the loan in full. This includes the principal amount, any interest that has accrued, and any fees that may be associated with the loan.

What is a single payment discounted loan?

A single payment discounted loan is a type of loan where the interest is calculated based on the payoff amount. This means that the interest will be discounted if you make your payments on time.

What is a precomputed interest loan?

A precomputed interest loan is a type of loan where the interest is calculated based on the interest rate and the loan term. This means that the interest will be charged upfront and will not change over the life of the loan.

What is balloon loan?

A balloon loan is a type of loan where the borrower makes small monthly payments for a set period of time, and then pays the remaining balance in one lump sum at the end of the loan term.