Businesses often take loan or mortgages to continue or expand business operation. In such cases, business need to maintain a book of record of all the creditors and their loan details.

Business can use this google sheets template for free to track the business indebtedness schedule.

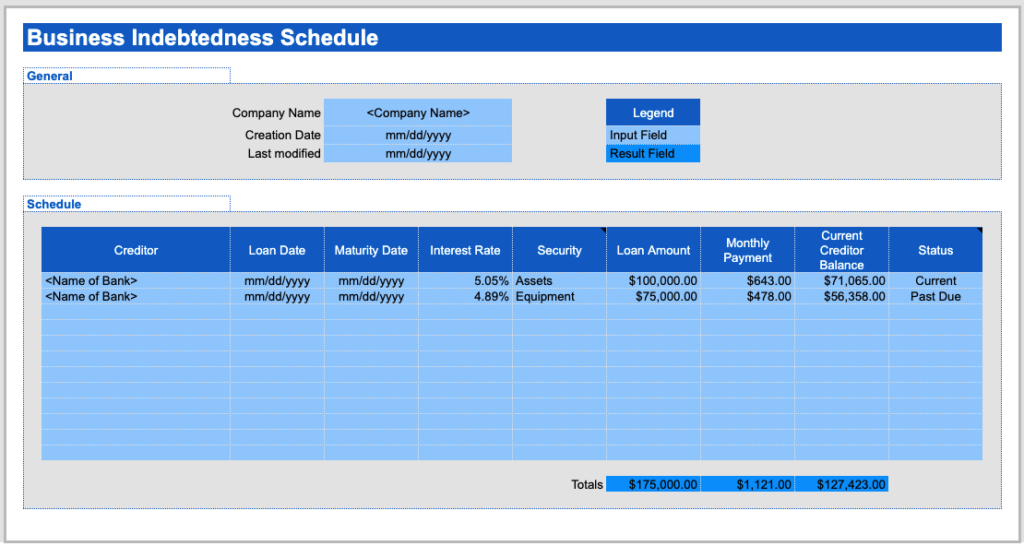

In this template, you have a section as header to fill with basic details of the comapny name, creation date, last modified date. Then in the schedule section you can list all the creditors name, loan date, maturity date, interest rate, security details, loan amount, monthly payment, current creditor balance and current status of the debt.

The template will calculate the total debt automatically for loan amount, monthly payment and current creditor balance.

| Name: | Business Indebtedness Schedule Template |

| Category: | Business, Finance |

| Application: | Google sheets |

| Tags: | Business Indebtedness Schedule Template google sheets |

Screenshots of the template:

FAQ:

What is the Business Indebtedness Schedule?

The Business Indebtedness Schedule (BIS) is a form used by businesses to report their debts to the Internal Revenue Service (IRS). The schedule is used to determine the business’s tax liability and is filed with the business’s tax return.

Why is it important?

The BIS is important because it provides the IRS with information about the business’s debts. This information is used to determine the business’s tax liability. The BIS is also used to calculate the business’s net worth.

What if you do not do it?

If you do not file the BIS, you may be subject to penalties and interest.

What are the penalties and interest rates?

The penalties and interest rates for not filing the BIS vary depending on the circumstances.

What is one example of a penalty?

One example of a penalty for not filing the BIS is a failure-to-file penalty. This penalty is 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25%.

Should all businesses need to report this or there are some exceptions?

There are some exceptions to the requirement to file the BIS. These exceptions include businesses that are exempt from taxation, businesses with no tax liability, and businesses that are not required to file a tax return.

How to prepare a Business Indebtedness Schedule report?

Preparing a Business Indebtedness Schedule is not difficult. The first step is to gather all of the information about the business’s debts. This information should include the name and address of the creditor, the amount of the debt, the interest rate, the date the debt was incurred, and the monthly payment amount.

The next step is to complete the BIS form. This form is available on the IRS website. The form must be completed in its entirety and signed by the business owner.

Once the form is complete, it should be mailed to the IRS.

What is the mailing address?

The mailing address for the BIS is:

Internal Revenue Service

P.O. Box 7122

Ben Franklin Station

Washington, DC 20044