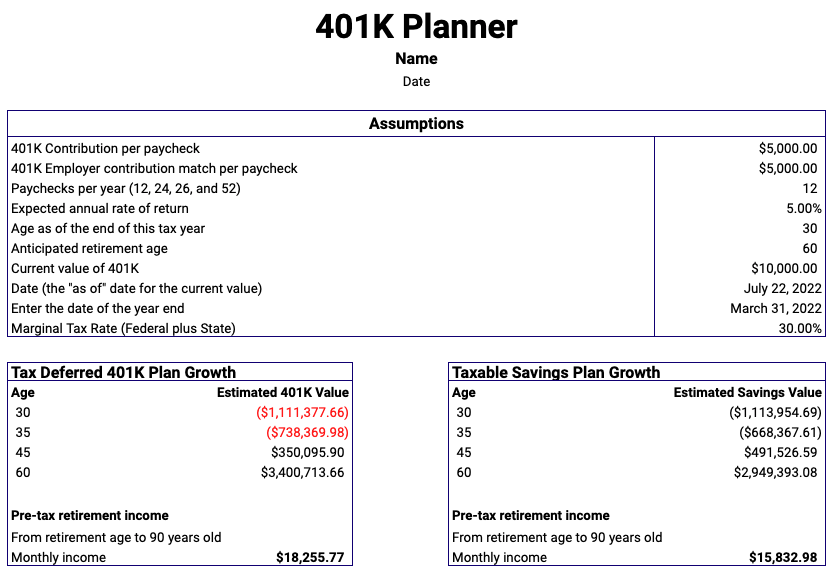

A 401k planner is a financial advisor who helps individuals save for retirement by investing in a 401k plan. A 401k plan is a retirement savings plan that allows individuals to save and invest for retirement on a tax-deferred basis.

You can use this free 401k planner template for google sheets to plan your 401k allotment without using any online software or app.

| Name: | 401k Planner template |

| Category: | Personal Finance |

| Application: | Google sheets |

| Tags: | 401k planner template google sheets |

Screenshots of the template:

FAQ:

What is a 401k planner?

A 401k planner is a financial advisor who helps individuals save for retirement by investing in a 401k plan. A 401k plan is a retirement savings plan that allows individuals to save and invest for retirement on a tax-deferred basis.

Why do you need a 401k planner?

A 401k planner can help you save for retirement by investing in a 401k plan. A 401k plan is a retirement savings plan that allows individuals to save and invest for retirement on a tax-deferred basis. A 401k planner can help you choose the right 401k plan for your needs and goals, and can also help you manage your 401k plan and investments.

How to prepare a 401k plan?

A 401k plan is a retirement savings plan that allows individuals to save and invest for retirement on a tax-deferred basis. To prepare a 401k plan, you will need to choose a 401k provider and an investment mix for your 401k account. You will also need to make sure you are contributing enough to your 401k account to reach your retirement goals.

How does 401k grow?

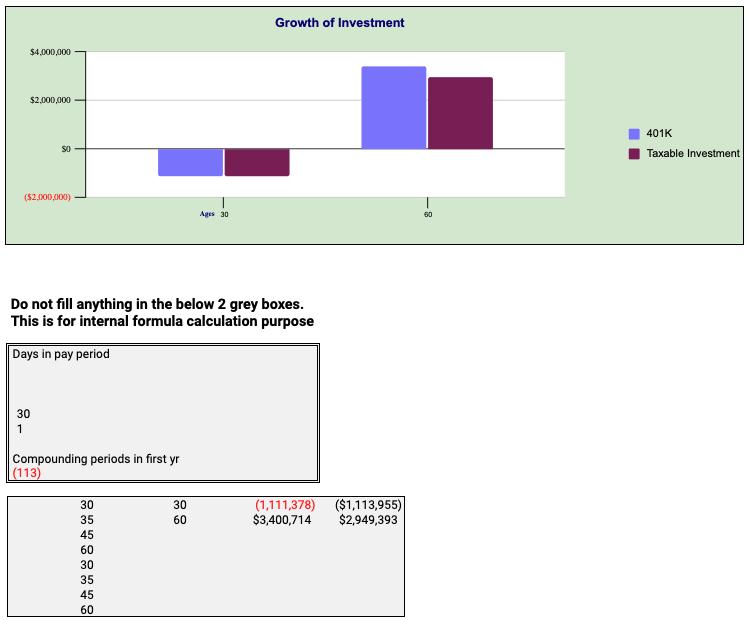

A 401k plan grows through contributions from the employer and employee, and through investment earnings. Contributions to a 401k plan are made on a pre-tax basis, which reduces the employee’s current taxable income. Investment earnings in a 401k plan are tax-deferred, which means they are not subject to income tax until they are withdrawn from the plan.

How much can I get in return after retirement?

The amount you will receive after retirement depends on a number of factors, including how much you have contributed to your 401k plan, the performance of your investments, and the amount of taxes you will owe on your withdrawals.

What is compound interest?

Compound interest is interest that is earned on both the principal (the original investment) and the interest that has been earned previously. Compound interest is often referred to as “compounding” because the interest is added to the principal, and then the interest is earned on the new, higher principal.